Inflation eases sharply in February

By Luisa Maria Jacinta C. Jocson, Reporter HEADLINE INFLATION sharply decelerated in February to its slowest print in five months, preliminary data from the Philippine Statistics Authority (PSA) showed. The consumer price index (CPI) eased to 2.1% in February from 2.9% in January and 3.4% a year ago. It was below the 2.2%-3% forecast from […]

By Luisa Maria Jacinta C. Jocson, Reporter

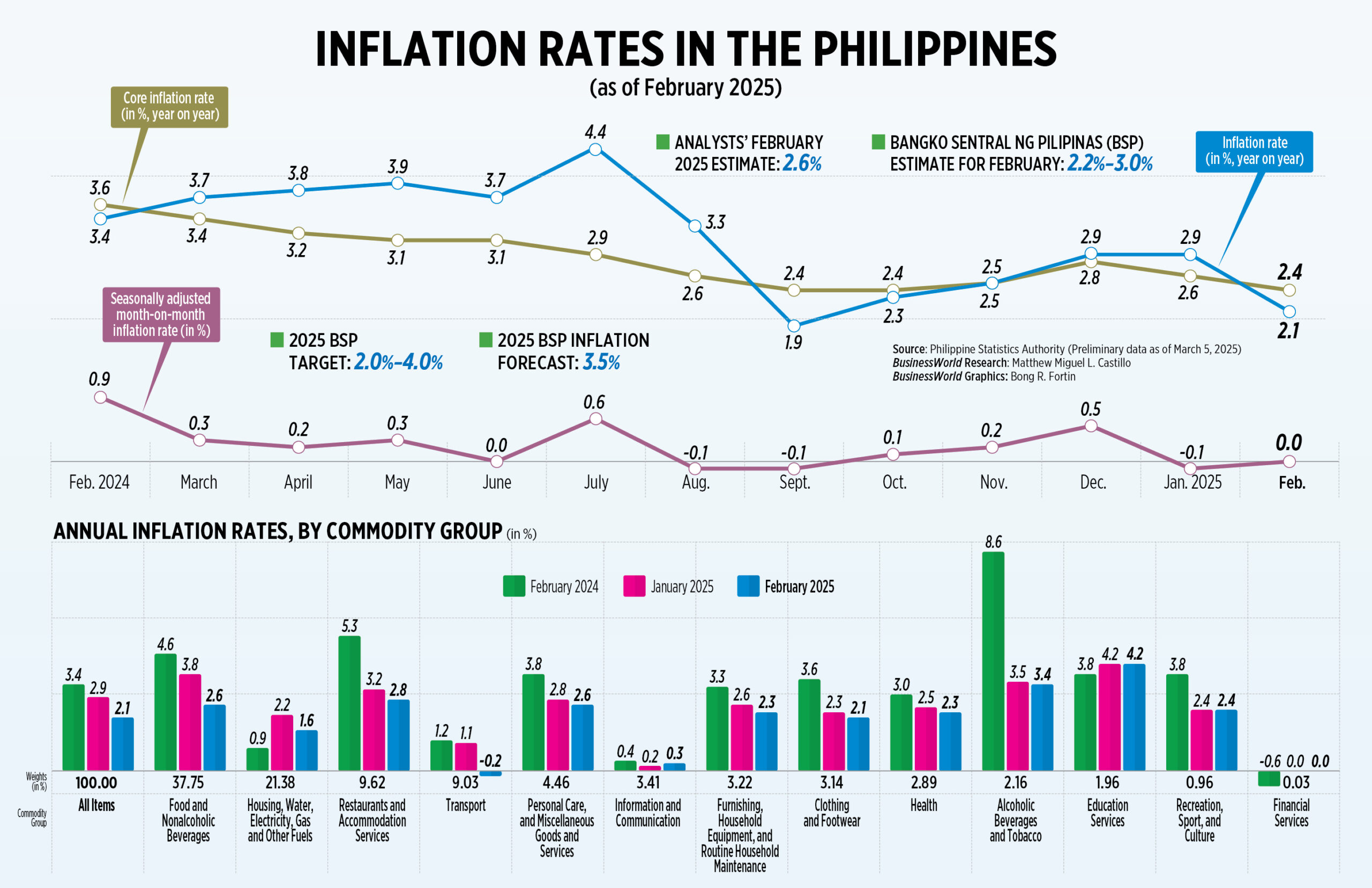

HEADLINE INFLATION sharply decelerated in February to its slowest print in five months, preliminary data from the Philippine Statistics Authority (PSA) showed.

The consumer price index (CPI) eased to 2.1% in February from 2.9% in January and 3.4% a year ago. It was below the 2.2%-3% forecast from the Bangko Sentral ng Pilipinas (BSP).

This was the slowest inflation print in five months or since the 1.9% clip in September 2024.

The February print was also well below the 2.6% median estimate in a BusinessWorld poll of 18 analysts conducted last week.

Inflation averaged 2.5% in the first two months, well within the central bank’s 2-4% target.

Core inflation eased to 2.4% in February from 2.6% in the previous month and 3.6% a year prior. Core inflation discounts volatile prices of food and fuel.

PSA Assistant Secretary Divina Gracia L. Del Prado said the main source of deceleration during the month was the heavily weighted food and nonalcoholic beverage index, accounting for a 58.8% share to the downtrend in inflation.

The index slowed to 2.6% in February from 3.8% in January and 4.6% in the same month in 2024.

Food inflation eased to 2.6% in February from 4% a month ago and 4.8% the year prior.

Cereals and cereal products, which include rice, fell to 3% in February from the 1.1% drop in January.

Rice inflation decreased to 4.9% in February from the 2.3% drop in January. This was the lowest rice inflation print since the 5.7% contraction in April 2020.

In February, the average price of regular milled rice fell to P47.23 per kilo from P50.44 a year earlier. Well-milled rice prices slipped to P53.46 a kilo from P55.93 a year ago, while special rice dropped to P62.65 a kilo from P64.42 a year ago.

“We are seeing the effect of the food security emergency, because we were able to release buffer stocks from the National Food Authority (NFA),” Ms. Del Prado said.

The Agriculture department last month declared a food security emergency on rice, which authorized the NFA to release buffer stocks at subsidized prices. Local government units can buy NFA rice at P33 per kilo and sell it to the public at P35 per kilo.

In mid-February, the department also lowered the maximum suggested retail price (MSRP) of 5% broken imported rice to P52 per kilo from P55 previously. This was further slashed to P49 per kilo, starting March 1.

Ms. Del Prado said rice inflation could remain in the negative for the rest of the year amid continued interventions by the government.

Meanwhile, the inflation of vegetables, tubers, plantains, cooking bananas and pulses decelerated to 7.1% in February from 21.1% a month prior.

Though still elevated, several vegetables posted a slower annual increase in prices. In particular, cabbage slowed to 33.4% in February from 39% in January; okra to 5.5% from 15.3%; and squash to 8.6% from 16.4%.

On the other hand, meat of pigs was the top contributor to February inflation, accounting for 16.2% or 0.3 percentage point to inflation. The inflation of pig meats rose to 12.1% in February from 8.4% in January.

This could be attributed to the rise in African Swine Fever cases, PSA’s Ms. Del Prado said.

For example, the average retail price of fresh pork kasim rose to P352.89 per kilo in February from P337.38 per kilo in the prior month.

The government’s plan to impose an MSRP on pork would help slow down inflation. “Once there is a maximum suggested retail price for pork, it might lead to a deceleration or even a negative inflation for pork,” Ms. Del Prado said.

PSA data showed the housing, water, electricity, gas and other fuels index slowed to 1.6% in February from 2.2% in January.

Electricity inflation dropped to 1% from the 0.2% acceleration a month ago.

This even as Manila Electric Co. (Meralco) raised the overall rate by P0.2834 per kilowatt-hour (kWh) to P12.0262 per kWh in February from P11.7428 per kWh in January.

Inflation of rentals also eased to 1.6% from 2% while liquefied petroleum gas (LPG) prices slowed to 3.7% from 4.7%.

Transport inflation was also a source of slower inflation in February, as it edged lower to 0.2% from the 1.1% rise in January.

In February, pump price adjustments stood at a net decrease of P0.05 a liter for diesel and P0.90 a liter for kerosene. However, gasoline had a net increase of P2.1 a liter.

Meanwhile, inflation for the bottom 30% of income households decelerated to 1.5% in February from 2.4% in January and 4.2% a year ago.

Consumer prices in the National Capital Region (NCR) eased to 2.3% in February from 2.8% in January. Outside NCR, inflation slowed to 2% from 2.9%.

EFFORTS TO TAME PRICES

“This sustained downward trend confirms that our proactive measures to curb inflation are delivering results, especially on helping alleviate the burden on vulnerable sectors,” Finance Secretary Ralph G. Recto said.

National Economic and Development Authority Secretary Arsenio M. Balisacan likewise said the downtrend in inflation shows the government’s efforts are working to tame prices.

“However, we will not be complacent in addressing causes of commodity price increases, particularly for food, to help uplift the lives of poor and vulnerable Filipino families, especially,” he added.

Mr. Balisacan said the government will continue to sustain its efforts to keep inflation manageable.

However, he warned the country may be hit by six to 13 typhoons from March to August.

“The Department of Agriculture (DA) will implement the La Niña action plan to restore agricultural productive capacity in areas likely to be affected by continuous rainfall, flooding, and landslides. The action plan includes water management, financial assistance and credit support, and a massive information campaign on La Niña,” Mr. Balisacan said.

Analysts said inflation is expected to remain within the 2-4% target band for the coming months.

“Barring any unexpected shocks, we project that inflation will remain within the BSP’s 2-4% target, though we remain cognizant of upside risks such as higher electricity prices, transport fare hikes, and potential increases in global commodity prices due to higher tariffs,” Chinabank Research said in a report.

Standard Chartered Bank economist and FX (foreign exchange) analyst Jonathan Koh Tien Wei said lower prices of rice and rent, as well as contained core inflation are helping offset upside risks from higher electricity prices.

“We do not think that today’s lower inflation print necessarily bolsters the case for the BSP to cut earlier in April — the key reason for the pause in February was external uncertainty. Growth and inflation fundamentals already pointed to-wards further easing,” Mr. Koh Tien Wei said.

“If USD-PHP does break below P57 or if the Fed does turn dovish because of weak jobs data, then that may give BSP a window to cut rates in April to provide much needed support to the economy.”

The peso closed at P57.345 per dollar on Wednesday, strengthening by 40.8 centavos from its P57.753 finish on Tuesday. This was the peso’s best finish since its P57.205-per-dollar close on Oct. 11, 2024.

Dino Angelo C. Aquino, vice-president and head of fixed income at Security Bank Corp., said that 75 bps worth of cuts for the year is a “conservative” estimate.

“If you look at pre-pandemic, the spread between the inflation rate and the policy rates is around 150 bps,” Mr. Aquino said in an interview on Money Talks with Cathy Yang on One News on Wednesday.

“So, right now, it’s huge. Say if we average 3% (inflation) conservatively, and your policy rate is at 5.75%. Technically, they have 125 bps room to cut rates. So, 75 for me is a little bit conservative if you ask me.”

The BSP unexpectedly kept rates steady last month after cutting rates for three straight meetings last year.

However, Mr. Remolona has said the central bank is still in easing mode, signaling the possibility of up to 50 bps worth of cuts this year.

The Monetary Board’s next rate-setting meeting is on April 3.