Factory activity expands in Nov.

By Aubrey Rose A. Inosante, Reporter PHILIPPINE MANUFACTURING ACTIVITY jumped to a 30-month high in November, as firms anticipate stronger demand in the coming months, a survey by S&P Global showed on Monday. The S&P Global Philippines Manufacturing Purchasing Managers’ Index (PMI) rose to 53.8 in November from 52.9 in October. This was the strongest […]

By Aubrey Rose A. Inosante, Reporter

PHILIPPINE MANUFACTURING ACTIVITY jumped to a 30-month high in November, as firms anticipate stronger demand in the coming months, a survey by S&P Global showed on Monday.

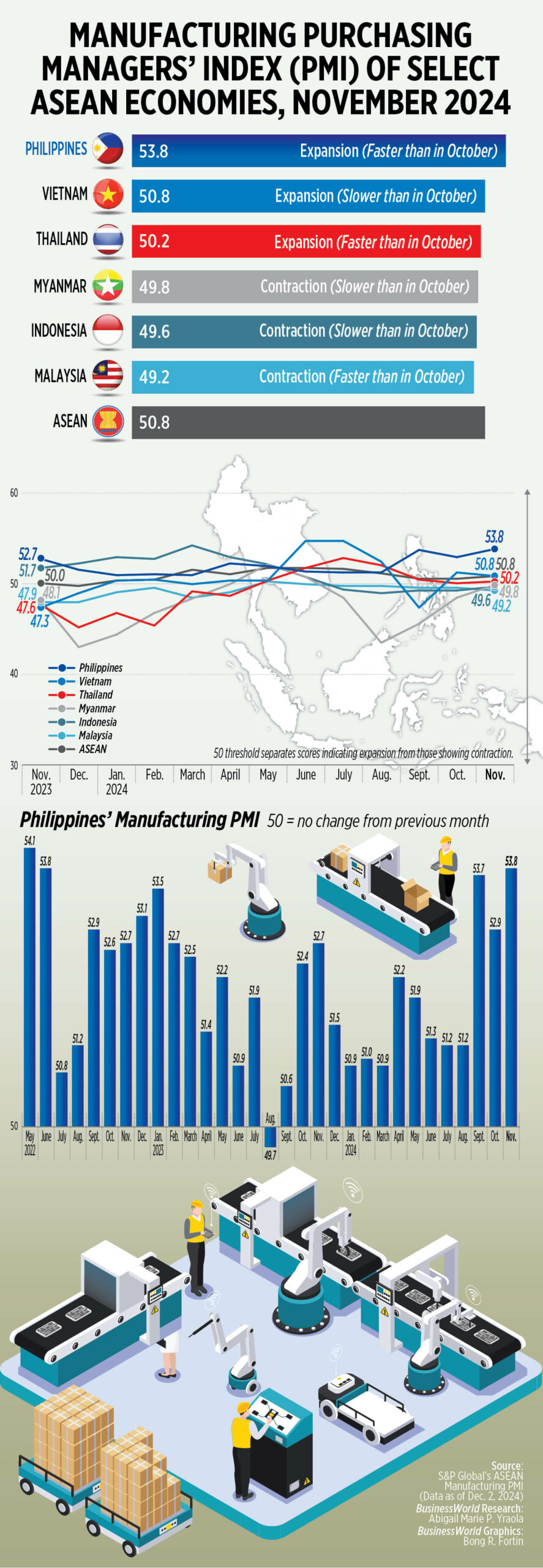

The S&P Global Philippines Manufacturing Purchasing Managers’ Index (PMI) rose to 53.8 in November from 52.9 in October. This was the strongest improvement in operating conditions since the 54.1 reading in May 2022.

It also marked the 15th straight consecutive monthly improvement in manufacturing activity in the Philippines.

A PMI reading above 50 means improved operating conditions from the previous month, while a reading below 50 shows deterioration.

“November saw the Filipino manufacturing sector ramping up production in anticipation of greater sales in the coming months,” Maryam Baluch, economist at S&P Global Market Intelligence, said in a report.

“Hiring, purchasing activity and post-production inventories were also raised in preparation. New sales recorded further growth, as demand conditions continued to improve.”

The Philippines posted the highest PMI reading among six Association of Southeast Asian Nation (ASEAN) member countries, followed by Vietnam (50.8) and Thailand (50.2).

Myanmar (49.8), Indonesia (49.6) and Malaysia (49.2) all saw a contraction in PMI in November.

“Last month’s headline improvement was led by a big bounce in the Philippines’ gauge to 53.8 from 52.9, with the archipelago’s stellar outperformance in this survey continuing to mask a lot of the softness across the broader region,” Pantheon Macroeconomics Chief Emerging Asia Economist Miguel Chanco said in an e-mailed statement.

The average PMI among the six Southeast Asian economies stood at 50.8.

“Manufacturers eagerly anticipated a sales boost in the months ahead, prompting a notable ramp-up in production during the latest survey period, with growth accelerating from October,” S&P said.

It noted that the increased production went to supporting the growth of new sales, as demand conditions rose for a 15th straight month.

“While the pace of increase moderated to a three-month low, it remained solid and historically strong. The uptick in output was also attributed by companies to inventory building,” S&P said.

S&P said the inventory of finished goods increased for the first time in four months, with the pace of accumulation the fastest in two years.

Manufacturers also ramped up hiring in November.

“Companies expanded their capacity further as job creation was recorded for a third straight month. The pace of increase was just shy of October’s recent peak,” it said.

S&P said purchasing activity increased in November, but this did not result in a rise in pre-production inventories since companies used the inputs for current production.

“Some supply-side challenges acted as headwinds, as adverse weather conditions resulting from the recent typhoons hitting the country and rising inflationary pressures make a difficult environment for manufacturers,” Ms. Baluch said.

S&P noted the November data showed signs that supply chains are still “strained.” It noted that typhoons led to port congestion and flooding “with average lead times lengthening rapidly and to the most significant degree in over three years.”

In November, S&P said that inflationary pressures “intensified” as rising costs of supplies and raw materials led to a faster increase in expenses — the strongest since February 2023.

Charges for Filipino manufactured goods went up in November, as output charge inflation reaching a 21-month high.

“Nonetheless, firms remained optimistic about future output, with hopes that improved demand trends and the upcoming election year will provide a boost to the sector,” Mr. Baluch said.

S&P noted that manufacturers’ sentiment in November was the highest since early 2023.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said factory activity rose as firms made preparations for the Christmas holiday season.

Mr. Ricafort said further rate cuts and a “benign inflation rate” would be beneficial for the economy, including manufacturing, though with some lag effects.

The Monetary Board could deliver another rate cut either at its December policy review or the meeting after, Bangko Sentral ng Pilipinas (BSP) Governor Eli M. Remolona, Jr. said earlier.

Since starting its easing cycle in August, the BSP has cut rates by 50 basis points, bringing the benchmark rate to 6%.